We have carefully thought out our tokenomics, taking into account the experience of the best projects in the crypto industry.

TamgaDAO — Tokenomics 1.1

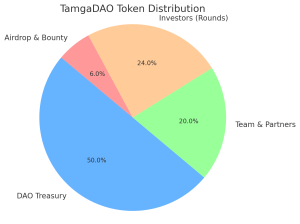

1. General Token Characteristics and Distribution

- Total Supply: 500,000,000 TAMGA (fixed, non-inflationary)

- Blockchain: Arbitrum (via the Colony platform)

- Token Type: Utility / Governance

Token Allocation:

- DAO Treasury: 50% (250,000,000 TAMGA)

- Team & Partners: 20% (100,000,000 TAMGA)

- Investors (Rounds): 24% (120,000,000 TAMGA)

- Airdrop & Bounty: 6% (30,000,000 TAMGA)

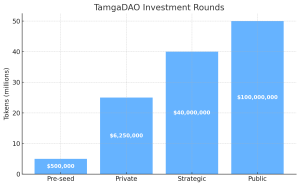

2. Investment Rounds

| Round | Period | Price | Tokens | Raise ($) | Terms |

| Pre-seed | Jun–Aug 2025 | $0.10 | 5,000,000 | $500,000 | 12-month lockup + 24-month vesting (quarterly) |

| Private | Nov–Dec 2025 | $0.25 | 25,000,000 | $6,250,000 | 12-month lockup + 24-month vesting (quarterly) |

| Strategic | Sep–Nov 2026 | $1.00 | 40,000,000 | $40,000,000 | 6-month lockup + 18-month vesting (quarterly) |

| Public | May–Jul 2027 | $2.00 | 50,000,000 | $100,000,000 | 20% unlocked in 2 months, 80% monthly vesting (18 months) |

Total Target Raise: $146.75 million

3. Token Allocation to Team and Partners

| Stage | Activation Condition | Share | Tokens | Terms |

| Stage 1 | Readiness for Private Round | 2% | 10,000,000 | 6-month lockup → 12-month vesting (quarterly); realization allowed during Strategic–Public |

| Stage 2 | Readiness for Strategic Round | 8% | 40,000,000 | 12-month lockup → 24-month vesting (quarterly) |

| Stage 3 | Completion of Public Round | 10% | 50,000,000 | Linear vesting over 36 months; no immediate unlock |

4. Airdrop and Bounty (6%)

- Launch: After completion of the Private round (from 2026)

- Vesting period: 6 years

- Unlock rate:

- 1% per year

- Up to 2% before Strategic round

- Up to 4% before end of Public round

- Mechanism: Monthly on-chain claim through a built-in vesting system

Bounty Program

The TamgaDAO Bounty Program targets active engagement of local experts, consultants, and media partners to promote the DAO, provide tokenization consulting, and grow the community. Participants are rewarded in TAMGA tokens based on transparent performance metrics.

This program aims to boost brand visibility and prepare local markets in priority jurisdictions, giving TamgaDAO a competitive edge in bridging traditional business and Web3.

Airdrop Strategy

TamgaDAO’s Airdrop is not just a token giveaway. It is a strategic onboarding initiative targeting legal entities ready for tokenization within the Web3 ecosystem of TamgaChain.

Objectives:

- Build a verified base of legal entities ready to engage with RWA

- Involve businesses in DAO governance and Web3 voting

- Create a market for TamgaProject, TamgaStake, and REPO tools

- Expand DAO geographically

5. Token Price Stabilization

Anti-Dump Mechanisms:

- OTC sales are prohibited until the token is listed, unless approved by DAO

- All wallet addresses and transactions are tracked on-chain

Buyback Fund:

The DAO has the right to initiate a buyback in case of:

- Price falling below $2.00

- High market volatility

Buybacks are initiated via DAO voting and executed through TamgaHub

6. Investor Exit Strategies

Exchange Listing

TAMGA will be listed on TamgaHub, DEXs, and CEXs after the Public round.

Buyback

Early contributors may sell tokens back after the token sale, subject to DAO vote and price stabilization.

OTC Restrictions

OTC transactions are prohibited until the token sale ends, unless explicitly approved by the DAO.

Priority Access

Investors from earlier rounds may receive priority access to:

- REPO programs

- Staking initiatives

- DAO-funded products

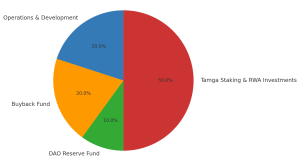

7. Allocation of Raised Funds

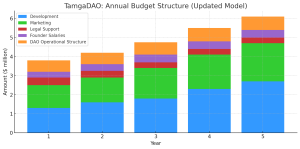

| Category | Amount ($) | Share | Timeframe | Purpose |

| Operations & Development | $29,350,000 | 20% | 5 years | Platform and protocol development, marketing, legal, salaries, DAO support |

| Buyback Fund | $29,350,000 | 20% | As needed | Buybacks below $2.00, price stabilization, volatility management |

| DAO Reserve Fund | $14,675,000 | 10% | Lifecycle | Risk insurance, liquidity support, emergency scenarios |

| Tamga Staking & RWA Investments | $73,375,000 | 50% | Ongoing | RWA-backed staking, DeFi investments, yield generation |

8. Core Tokenomics Principles

Fixed Supply & Transparency

- Max supply is 500,000,000 TAMGA

- All allocations are encoded in smart contracts

- No inflation, protecting long-term token value

Real-World Asset Backing (RWA)

- TAMGA is backed by tokenized real assets (land, grain, real estate, etc.)

- Staking is linked to real economic activity

- Revenue is shared between the DAO and stakers

Financial Sustainability

- 50% of raised funds go to RWA staking and investments

- 20% for buyback, 10% for reserves, all managed by DAO

- 20% for operations ensures budget efficiency

Vesting & Protection

- Investors, team, and partners have strict lockups and vesting

- Airdrop & Bounty distributed evenly over 6 years (max 1% per year)

- Public round: 20% unlocked at TGE, rest vested over 18 months

- OTC deals monitored and restricted until listing

Decentralized Governance

- All key decisions are subject to DAO voting

- TAMGA stakers can participate in governance if they meet token thresholds

- Colony on Arbitrum powers role/task/budget management

Growth-Oriented Design

- Non-inflationary staking (no new token emissions)

- Business-focused Airdrop & Bounty strategies

- Revenue grows via consulting, TamgaHub, and expansion of RWA tokenization